|

Calculation of Revenue from Pension Tax April 8, 2024

Each year, Treasury's Office of Revenue and Tax Analysis does a report on Michigan's Individual Income Tax. The reports are always a few years behind to allow all the returns to be processed, refunds made, etc. The latest is for 2021. You can see that report here. Links to reports for previous years are here.

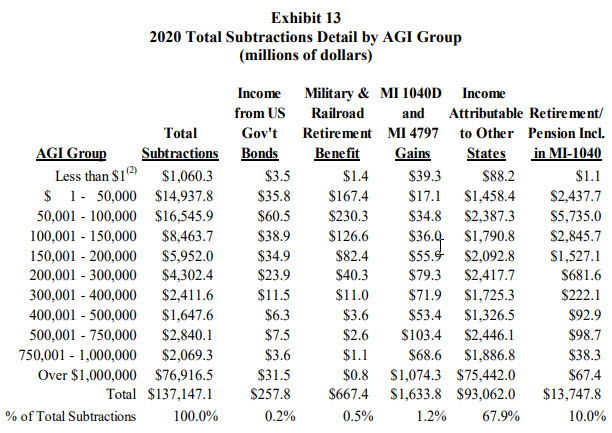

One of the items reported each year is subtractions from federal adjusted gross income (AGI) (page 20):

The figure I am interested in is the Retirement/Pension total, which for 2021 (above) was $15,134,500,000. I also got that figure from the reports for 2011-2020. 2011 was the year before the pension tax kicked in. I also got the tax rate for those years. Multiplying the retirement/pension subtraction total by the tax rate should roughly provide the revenue loss (total revenue and tax rate come from page 11 of the report):

With the revenue loss for a given year, we can calculate the revenue gain from the pension tax by comparing it to the revenue loss for 2011, the year before the pension tax went into effect. For example, the revenue loss for 2021 was $643,216,250. Subtract that from $1,002,562,000, the revenue loss for 2011, and the result is $418,280,500. That is the revenue gain over 2011.

Legislative changes to the income tax since 2011 have reduced the expected revenue gain from the pension tax. Pensions from service in the Michigan National Guard were made exempt effective for the 2012 tax year. Effective for the 2013 tax year, the exemption amount for retirees born between 1946 and 1952 was increased for those whose employment was not covered by the Social Security Act (some police and firefighters). And in 2017, that enhanced exemption for retirees not covered by Social Security was extended to those born after 1952, provided they retired as of January 1, 2013. See Subsequent legislation ruins Michigan's pension tax.

The table below shows the trend. The middle column is the revenue loss from the above table. The column on the right is the 2011 loss minus the current tax year loss, or the revenue increase from the pension tax. It peaked in 2014 and has gone down each year since.

In her 1/26/2022 State of the State address, Governor Gretchen Whitmer said that repealing the pension tax would mean an extra $1,000 on average for 500,000 Michiganders. That is $500,000,000 a year, not far off from my calculation. It would be interesting to see how she came up with her figures.

To the $4,263,836,250 total through 2021, add an estimated $300,000,000 each for yet-to-be-reported 2022 and 2023 and you have a total revenue gain of $4,863,836,250. |