|

Pension Calculation Sheets

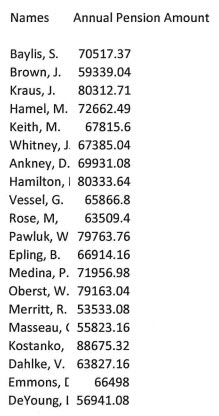

In August of 2017, the Lansing State Journal printed a story called "Overtime spikes pensions for dozens of Lansing police, fire retirees." The story was based on pension amounts obtained from the City of Lansing for 160 police and fire retirees. I suspected that the pension amounts were not the full amounts. Pensions are calculated as service times final average compensation (FAC) times a multiplier - in this case, 3.2%. For example, if a firefighter has 25 years of service (the minimum required) and his average pay for the last 2 years was $80,000, his pension would be $64,000 (25 x 80,000 x .032). This amount is called the "straight life amount," and is not necessarily the same as the pension. The pension payment amount may be less depending on the survivor option chosen by the retiree. One option allows the surviving spouse to receive 75% of the pension, and to pay for it, the pension received by the retiree is reduced to 93% of the full allowance. Another allows the surviving spouse to receive 86% of the pension and the pension received by the retiree is reduced to 86%.

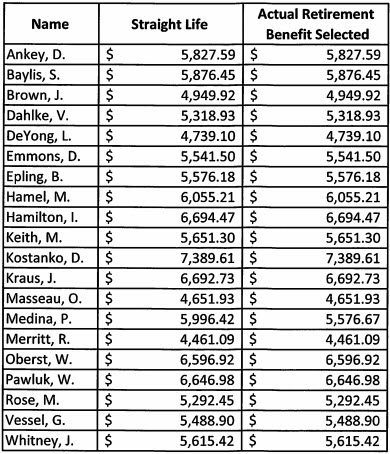

I set about getting the straight life amounts. Getting them for all 160 Police & Fire retirees was too expensive, so I asked for the straight life amounts for a list of 20 retirees who retired in 2015 and 2016. The City responded with a one-page list.

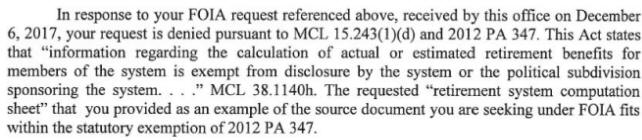

All of the amounts matched what was given the LSJ except for P. Medina's. The "monthly retirement benefit" given the LSJ was $5.576.67, which is $66,920.04 a year, while the straight life amount they gave me (above) was $71,956.98. $66,920.04 is 93% of $71,956.98, which suggests that $71,956.98 was indeed the straight life amount. I could not believe, however, that the amounts given for the other 19 were straight life amounts, so I requested the actual pension calculation sheets for all 20. My request was denied:

I appealed the denial to the city council president Patricia Spitzley. I said I was aware of the exemption for pension calculation details, but

The second reason was that the complaint was not filed within the 180 day limit. My January 5 request was definitely within the 180 days, but the City claimed it was not FOIA request "because Plaintiff acknowledges that he knows the information requested is exempt from disclosure under FOIA and instead instructs the City of Lansing how to redact the requested information, a power not granted to the individual requestor under FOIA." Apparently, their feelings were hurt because I suggested how they could do their job.

The letter points out that "Patricio Medina is the only employee on the list whose straight life amount varies from the actual retirement benefit amount selected."

I decided there was no point in pursuing the issue. Although it is hard for me to believe that only one of the 20 chose a beneficiary option that required a pension reduction, I could not prove otherwise without the pension calculation sheets. I told my attorney to ask Judge Canady to order the City to reimburse me for my attorney fees and pay the $1000 penalty for improperly denying a FOIA request. Instead, the judge granted the City's request for summary disposition and declined to order the City to pay anything. I was stuck with $3,376.62 in attorney fees.

Police & Fire survivor option costs nothing

The reason I just couldn't believe that only one out of 20 P&F retiree pensions were reduced due to survivor benefits was that I didn't realize that one of the survivor options - the one where the spouse receives 50% of the benefit upon the retiree's death - does not result in a pension reduction. An explanation of P&F survivor options is here. I am a retired state employee, and all of our survivor options result in a pension reduction. This is from the website of the Michigan Office of Retirement Systems:

So it is not that P&F retirees did not choose a survivor option; it's that they chose the one where the spouse receives 50% of the benefit upon the retiree's death and there is no pension reduction. It is another valuable pension benefit on top of being able to retire at any age with 25 years of service, a 2-year FAC period and a 3.2% multiplier.

The above was adapted from my September 25, 2018 story Failed FOIA lawsuit costs me $3,376.62. |

||||||||||||||