|

Failed FOIA lawsuit costs me $3,376.62

September 25, 2018

On August 10 of last year, the Lansing State Journal

printed a story called "Overtime spikes pensions for dozens of Lansing police, fire retirees."

The story was based on pension amounts obtained from the City of Lansing

for 160 police and fire retirees. I suspected that the pension amounts

were not the full amounts. Pensions are calculated as service times

final average compensation (FAC) times a multiplier - in this case,

3.2%. For example, if a firefighter has 25 years of service (the minimum

required) and his average pay for the last 2 years was $80,000, his

pension would be $64,000 (25 x 80,000 x .032). This amount is called the

"straight life amount," and is not necessarily the same as the

pension. The pension payment amount may be less depending on the survivor

option chosen by the retiree. One option allows the surviving spouse to

receive 75% of the pension, and to pay for it, the pension received by

the retiree is reduced to 93% of the full allowance. Another allows the

surviving spouse to receive 86% of the pension and the pension received

by the retiree is reduced to 86%. The full text of that part of the city

ordinance is

here.

I set about getting the straight life amounts. I sent a Freedom of Information Act request asking for the

same information provided to the LSJ, but with straight life pension

amounts. The City

wanted well over $1000, so I

withdrew that request and asked for the same information provided to the LSJ. They sent me that document for free. It is a

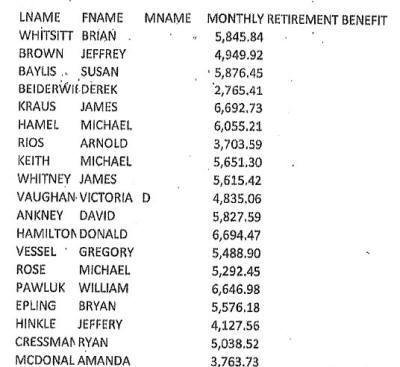

168 page PDF document. The first 4 pages are a list

of retirees and amounts. Here's a portion of

the first page:

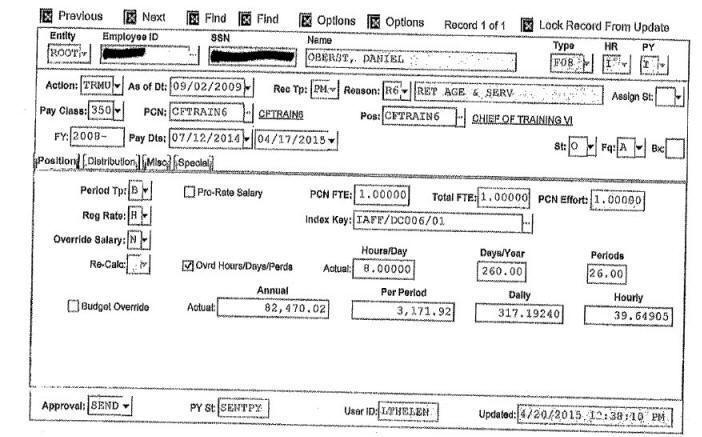

Each of the remaining 164 pages contained

a document that showed - among other information - the employee's base

pay amount. Here's an example:

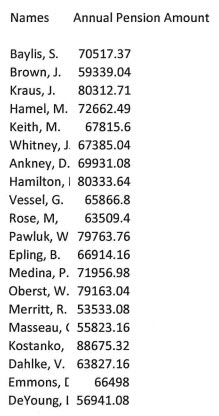

Still determined to get the straight life amounts, I sent a new request, this time for the

straight life amounts for a list of 20 employees who retired in 2015 and

2016. The City responded

with a

one-page list. I was not charged.

All of the amounts matched what was given the LSJ

except for P. Medina's. The "monthly retirement benefit" given the LSJ was

$5.576.67, which is $66,920.04 a year, while the straight life amount

they gave me (above) was $71,956.98. $66,920.04 is 93% of $71,956.98,

which suggests that $71,956.98 was indeed the straight life amount. I

could not believe, however, that the amounts given for the other 19 were

straight life amounts.

The reason I thought that is that I had the

straight life amounts for 42 retirees

from 2010-2012, and for 9 of those 42 -

over 20% of them - the pension provided to the LSJ was substantially

lower than the straight life amount. Starting in 2010 and ending before April 2013, when

Public Act 347 of 2012 went

into effect banning the release of information regarding the calculation

of retirement benefits, I routinely obtained pension calculation sheets for

City of Lansing retirees and posted them to this website. It is from those documents that I obtained the straight life pension

amount.

In the chart below, straight life amount is from

the pension calculation sheet, which you can see by clicking the retiree

name. LSJ annual ret benefit is the monthly retirement benefit provided to

the LSJ multiplied by 12. Any instance in which the straight life amount

substantially exceeds the annualized monthly retirement benefit suggests

that a survivor option was selected that requires a pension reduction.

There are 9 of them:

| |

Retiree |

Dept |

Retirement

Date |

Straight Life

Amount |

LSJ Monthly

Ret Ben |

LSJ Annual

Ret Benefit |

SLA-ARB |

ARB/SLA |

|

1 |

Ramsey, Matthew J. |

Police |

1/14/2010 |

55,063 |

4,588.60 |

55,063.20 |

|

100.0% |

|

2 |

James, Timothy A. |

Fire |

1/29/2010 |

76,780 |

5,985.58 |

71,826.96 |

4,953.04 |

93.5% |

|

3 |

Priebe, John P. |

Police |

2/14/2010 |

53,831 |

4,171.93 |

50,063.16 |

3,767.84 |

93.0% |

|

4 |

Stevens, Mary |

Police |

3/19/2010 |

61,698 |

4,486.61 |

53,839.32 |

7,858.68 |

87.3% |

|

5 |

Ness, David T. |

Fire |

5/7/2010 |

70,919 |

5,909.95 |

70,919.40 |

|

100.0% |

|

6 |

Koenigsknecht, Frank |

Police |

6/8/2010 |

59,486 |

5,000.94 |

60,011.28 |

|

100.9% |

|

7 |

Dionise, Joseph |

Police |

6/14/2010 |

67,177 |

5,611.42 |

67,337.04 |

|

100.2% |

|

8 |

Lindeman, Andrew J. |

Police |

6/14/2010 |

60,146 |

5,078.10 |

60,937.20 |

|

101.3% |

|

9 |

Meaton, Richard T. |

Police |

6/14/2010 |

53,826 |

4,485.52 |

53,826.24 |

|

100.0% |

|

10 |

Person, Stephen |

Police |

6/14/2010 |

68,159 |

5,679.88 |

68,158.56 |

|

100.0% |

|

11 |

Read Jr., Vern A. |

Police |

6/14/2010 |

56,631 |

4,719.24 |

56,630.88 |

|

100.0% |

|

12 |

Relyea, Steven H. |

Police |

6/14/2010 |

69,827 |

5,950.13 |

71,401.56 |

|

102.3% |

|

13 |

Schuelke, Scott |

Police |

6/14/2010 |

66,664 |

5,555.36 |

66,664.32 |

|

100.0% |

|

14 |

Wirth, Dennis |

Police |

6/14/2010 |

54,077 |

4,506.38 |

54,076.56 |

|

100.0% |

|

15 |

Burnett, Todd E. |

Fire |

6/14/2010 |

61,813 |

5,115.51 |

61,386.12 |

|

99.3% |

|

16 |

Fulger Jr., Charles J. |

Fire |

6/14/2010 |

65,259 |

5,656.99 |

67,883.88 |

|

104.0% |

|

17 |

Ferguson, Bruce |

Police |

6/16/2010 |

59,067 |

4,509.86 |

54,118.32 |

4,948.68 |

91.6% |

|

18 |

Ford, David R. |

Fire |

6/21/2010 |

70,356 |

5,862.99 |

70,355.88 |

|

100.0% |

|

19 |

Walsdorf, Joseph R. |

Fire |

6/21/2010 |

63,346 |

4,773.61 |

57,283.32 |

6,062.68 |

90.4% |

|

20 |

Huff Jr., Orval D. |

Fire |

6/23/2010 |

64,774 |

5,397.86 |

64,774.32 |

|

100.0% |

|

21 |

Smith, Paul M. |

Fire |

6/23/2010 |

69,084 |

5,757.03 |

69,084.36 |

|

100.0% |

|

22 |

Haueter, Peter L. |

Fire |

6/26/2010 |

71,350 |

5,945.82 |

71,349.84 |

|

100.0% |

|

23 |

Perrone, Daniel A. |

Fire |

6/30/2010 |

55,505 |

4,539.05 |

54,468.60 |

|

98.1% |

|

24 |

Halverson, Kim A. |

Police |

2/14/2011 |

53,580 |

4,464.97 |

53,579.64 |

|

100.0% |

|

25 |

Klaus, Larry S. |

Police |

2/14/2011 |

71,461 |

5,955.10 |

71,461.20 |

|

100.0% |

|

26 |

Barnes, William |

Police |

3/10/2011 |

55,966 |

4,010.90 |

48,130.80 |

7,835.20 |

86.0% |

|

27 |

Blackman, David S. |

Police |

3/10/2011 |

52,867 |

4,405.54 |

52,866.48 |

|

100.0% |

|

28 |

Medrano Jr., Frank |

Police |

3/20/2011 |

73,109 |

5,665.95 |

67,991.40 |

5,117.60 |

93.0% |

|

29 |

Doerr, David B. |

Fire |

6/15/2011 |

61,812 |

5,150.98 |

61,811.76 |

|

100.0% |

|

30 |

Kirchen, Thomas J. |

Fire |

6/15/2011 |

56,883 |

4,827.73 |

57,932.76 |

|

101.8% |

|

31 |

Squire, James E. |

Fire |

6/15/2011 |

60,242 |

5,020.15 |

60,241.80 |

|

100.0% |

|

32 |

Holden, Walter M. |

Fire |

6/16/2011 |

62,288 |

5,190.66 |

62,287.92 |

|

100.0% |

|

33 |

Tolbert, Jerome C. |

Fire |

6/18/2011 |

64,459 |

5,158.30 |

61,899.60 |

2,559.40 |

96.0% |

|

34 |

Pulver, Lynn A. |

Fire |

6/19/2011 |

64,613 |

5,384.56 |

64,614.72 |

|

100.0% |

|

35 |

Bey, Donald |

Police |

6/24/2011 |

51,039 |

4,296.96 |

51,563.52 |

|

101.0% |

|

36 |

Christainsen, William |

Fire |

6/24/2011 |

50,976 |

4,291.71 |

51,500.52 |

|

101.0% |

|

37 |

Peacock, Matthew A. |

Fire |

6/30/2011 |

72,526 |

6,060.91 |

72,730.92 |

|

100.3% |

|

38 |

Wojtysiak, Mark |

Fire |

6/30/2011 |

73,269 |

6,082.85 |

72,994.20 |

|

99.6% |

|

39 |

Sabon, Philip D. |

Fire |

7/1/2011 |

76,318 |

6,359.85 |

76,318.20 |

|

100.0% |

|

40 |

Trost, Jay S. |

Police |

8/19/2011 |

58,495 |

5,093.31 |

61,119.72 |

|

104.5% |

|

41 |

Janeski, Charles T. |

Police |

9/15/2011 |

70,529 |

5,465.97 |

65,591.64 |

4,937.36 |

93.0% |

|

42 |

Hall, Raymond |

Police |

2/18/2012 |

73,178 |

6,171.62 |

74,059.44 |

|

101.2% |

So if over 20% of the older 42 had survivor option

reductions, why did only one of the recent 20?

I thought maybe I was using the wrong term. Until

then, I hadn't actually read the section in the city ordinance about

survivor options, and when I did, I realized that the term "straight

life pension" does not appear. I sent a new FOIA request:

I have to apologize. In my previous FOIA

requests, I asked for the "straight life" pension amounts for

certain Police & Fire retirees. I now realize that this term is not

used in the Police & Fire Retirement System. It does not appear in

the ordinance. The term for what I want is "full retirement

allowance." I would like the full retirement allowance for [the 20

Police & Fire Retirement System retirees].

This time, there was a

charge: $125.88. There was no charge for the straight life pension

amounts I'd received earlier. Did that mean that the straight life

pension and the full retirement allowance were different?

I paid the $125.88. On December 1, I got another

one-page

list:

On this list, the amounts matched exactly the

amounts given to the LSJ.

On December 2, I sent another another

request:

I realize that in my original FOIA

request I did not specify that I wanted the source documents that

showed the full retirement allowance for the 20 retirees listed in

that request. However, the source documents are what I need, and the

$125.88 I paid should get me more than the single-page list of

retirees and amounts identified only as "monthly" that was provided

. . .

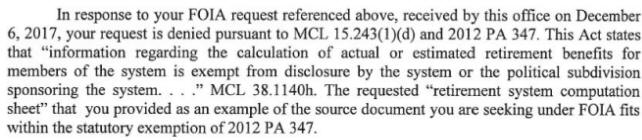

My request was

denied:

I appealed the denial to the city council president Patricia Spitzley on

December 11:

Dear Councilwoman Spitzley,

I would like to appeal the denial of a

FOIA request.

On October 17, I requested the "full

retirement allowance" for a list of 20 police and firefighters who

retired in 2015 and 2016. The full retirement allowance is the

calculated pension before any reductions for survivor options. It

has also been known as the straight life pension.

On December 1, after receiving my

payment of $125.88, the Office of City Attorney sent me a one-page

document (attached) listing the 20 retirees along with amounts

identified only as "Monthly." Since the "full retirement allowance"

is normally an annual amount rather than a monthly amount and since

no supporting documents were provided, I suspected that the amounts

provided were monthly pension payment amounts rather than the full

retirement allowance.

| |

On December 2, I submitted a new

request asking for the source documents for the retirement

allowances and I attached a "Retirement System Computation Sheet"

for a 2011 retiree ("Halverson," attached) as an example of what I

wanted.

On December 11, my request was denied

("Denial Letter," attached) because "information regarding the

calculation of actual or estimated retirement benefits . . . are

exempt from disclosure.

I accept that this is the law.

However, the information regarding the calculation of the benefit

could be redacted. That would consist of the final average

compensation (FAC), which is of no interest to me. My only interest

is the "full retirement allowance" or "straight life amount." I

already have retirement date, retirement age and service amount, all

of which are provided in Retirement Board meeting minutes.

Please ask the Retirement Office/City

Attorney to provide the 20 computation sheets with the FAC redacted.

|

|

|

Patricia Spitzley |

The City has had no

problem with redacting documents

in the past.

I received

her response December 20. She upheld the denial of my request.

On January 5, 2018, I sent the city attorney another FOIA request. I asked again for those 20 pension calculation sheets,

this time specifically asking that all calculation details other than

the straight life amount be redacted. My request was

denied on January 26. The

reason? "[B]ecause the only information sought in this request, straight

life pension amounts, has already been provided to you . . . on

October 9, 2017. The City confirmed that the information provided under

your earlier request has not changed since that time."

I appealed. New city council president Carol Wood

denied my appeal.

On June 11, I filed a

lawsuit asking the Court to compel the City to provide the 20 pension

calculation sheets. The delay in filing was partly because I was in Florida

through April and partly because of the time it took to find an

attorney.

On July 6, the City filed a

motion for

summary disposition. They gave two reasons. The first was that the

records were statutorily exempt from disclosure. However, the statute -

MCL 15.243(1)(d) - does not exempt records. It exempts

"information regarding the calculation of actual or estimated retirement

benefits. . ." The records - the calculation sheets - could have been

provided with the calculation information redacted.

The second reason was that the complaint was not

filed within the 180 day limit. My January 5 request was definitely within the 180

days, but the City claimed it was not FOIA request "because Plaintiff acknowledges that he knows the

information requested is exempt from disclosure under FOIA and instead

instructs the City of Lansing how to redact the requested information, a

power not granted to the individual requestor under FOIA."

Apparently, their feelings were hurt because I suggested how they could

do their job.

|

The hearing on the motion for summary

disposition was held August 15 before Judge Clinton Canady III.

He denied the City's motion, but did not order the City to

provide the pension calculation sheets. Instead, he told them to

provide me the straight life pension amounts.

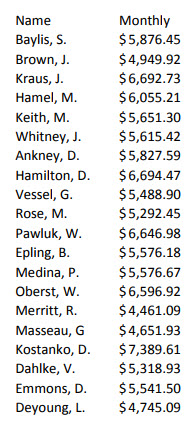

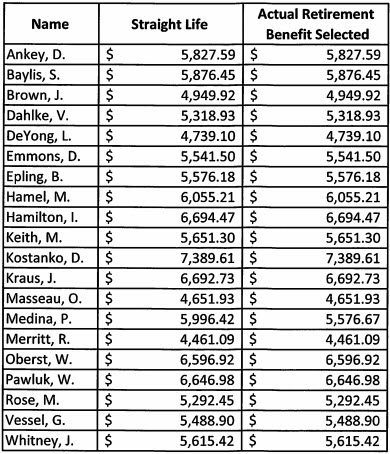

The City complied in an

August 29 letter that includes this chart:

|

|

|

Judge Clinton Canady III |

The letter points out that "Patricio Medina is the

only employee on the list whose straight life amount varies from the

actual retirement benefit amount selected."

I decided there was no point in pursuing the issue.

Although it is hard for me to believe that only one of the 20 chose a

beneficiary option that required a pension reduction, I could not prove

otherwise without the pension calculation sheets. I told my attorney to

ask Judge Canady to order the City to reimburse me for my attorney fees and

pay the $1000

penalty for improperly denying a FOIA request. Instead, the judge

granted the City's

request for summary disposition and declined to

order the City to pay anything. So I am stuck with $3,376.62 in attorney

fees.

I did prove that some of the pension amounts

provided by the City to the Lansing State Journal for their August 9,

2017 article were misleadingly small. Although only one of the 20 more

recent retirees had a straight life amount that was larger than the

pension, 9 of the 42 2010-12 retirees did - over 20%.

The reason it matters is that the LSJ found that 70

of 160 police and fire retirees received pensions over 90% of their base

wage. That is 43.8%. Twenty-seven of the straight life pensions

for the 42 retirees from 2010-12 were over 90% of base wage. That is

64.3% Here they are:

| |

Retiree |

Dept |

Retirement

Date |

Base

Wage |

Straight Life

Amount |

Straight Life/

Base Wage |

|

1 |

Ramsey, Matthew J. |

Police |

1/14/2010 |

61,195 |

55,063 |

|

90.0% |

|

2 |

James, Timothy A. |

Fire |

1/29/2010 |

97,251 |

76,780 |

|

79.0% |

|

3 |

Priebe, John P. |

Police |

2/14/2010 |

61,195 |

53,831 |

|

88.0% |

|

4 |

Stevens, Mary |

Police |

3/19/2010 |

67,198 |

61,698 |

|

91.8% |

|

5 |

Ness, David T. |

Fire |

5/7/2010 |

78,481 |

70,919 |

|

90.4% |

|

6 |

Koenigsknecht, Frank |

Police |

6/8/2010 |

67,198 |

59,486 |

|

88.5% |

|

7 |

Dionise, Joseph |

Police |

6/14/2010 |

67,198 |

67,177 |

|

100.0% |

|

8 |

Lindeman, Andrew J. |

Police |

6/14/2010 |

63,310 |

60,146 |

|

95.0% |

|

9 |

Meaton, Richard T. |

Police |

6/14/2010 |

61,195 |

53,826 |

|

88.0% |

|

10 |

Person, Stephen |

Police |

6/14/2010 |

73,930 |

68,159 |

|

92.2% |

|

11 |

Read Jr., Vern A. |

Police |

6/14/2010 |

61,195 |

56,631 |

|

92.5% |

|

12 |

Relyea, Steven H. |

Police |

6/14/2010 |

67,198 |

69,827 |

|

103.9% |

|

13 |

Schuelke, Scott |

Police |

6/14/2010 |

67,198 |

66,664 |

|

99.2% |

|

14 |

Wirth, Dennis |

Police |

6/14/2010 |

61,195 |

54,077 |

|

88.4% |

|

15 |

Burnett, Todd E. |

Fire |

6/14/2010 |

68,121 |

61,813 |

|

90.7% |

|

16 |

Fulger Jr., Charles J. |

Fire |

6/14/2010 |

71,725 |

65,259 |

|

91.0% |

|

17 |

Ferguson, Bruce |

Police |

6/16/2010 |

73,930 |

59,067 |

|

79.9% |

|

18 |

Ford, David R. |

Fire |

6/21/2010 |

78,481 |

70,356 |

|

89.6% |

|

19 |

Walsdorf, Joseph R. |

Fire |

6/21/2010 |

68,121 |

63,346 |

|

93.0% |

|

20 |

Huff Jr., Orval D. |

Fire |

6/23/2010 |

68,121 |

64,774 |

|

95.1% |

|

21 |

Smith, Paul M. |

Fire |

6/23/2010 |

78,481 |

69,084 |

|

88.0% |

|

22 |

Haueter, Peter L. |

Fire |

6/26/2010 |

78,481 |

71,350 |

|

90.9% |

|

23 |

Perrone, Daniel A. |

Fire |

6/30/2010 |

60,958 |

55,505 |

|

91.1% |

|

24 |

Halverson, Kim A. |

Police |

2/14/2011 |

61,195 |

53,580 |

|

87.6% |

|

25 |

Klaus, Larry S. |

Police |

2/14/2011 |

74,669 |

71,461 |

|

95.7% |

|

26 |

Barnes, William |

Police |

3/10/2011 |

57,192 |

55,966 |

|

97.9% |

|

27 |

Blackman, David S. |

Police |

3/10/2011 |

57,192 |

52,867 |

|

92.4% |

|

28 |

Medrano Jr., Frank |

Police |

3/20/2011 |

74,669 |

73,109 |

|

97.9% |

|

29 |

Doerr, David B. |

Fire |

6/15/2011 |

71,725 |

61,812 |

|

86.2% |

|

30 |

Kirchen, Thomas J. |

Fire |

6/15/2011 |

60,958 |

56,883 |

|

93.3% |

|

31 |

Squire, James E. |

Fire |

6/15/2011 |

68,121 |

60,242 |

|

88.4% |

|

32 |

Holden, Walter M. |

Fire |

6/16/2011 |

68,121 |

62,288 |

|

91.4% |

|

33 |

Tolbert, Jerome C. |

Fire |

6/18/2011 |

71,725 |

64,459 |

|

89.9% |

|

34 |

Pulver, Lynn A. |

Fire |

6/19/2011 |

68,121 |

64,613 |

|

94.9% |

|

35 |

Bey, Donald |

Police |

6/24/2011 |

58,050 |

51,039 |

|

87.9% |

|

36 |

Christainsen, William |

Fire |

6/24/2011 |

78,481 |

50,976 |

|

65.0% |

|

37 |

Peacock, Matthew A. |

Fire |

6/30/2011 |

78,481 |

72,526 |

|

92.4% |

|

38 |

Wojtysiak, Mark |

Fire |

6/30/2011 |

78,481 |

73,269 |

|

93.4% |

|

39 |

Sabon, Philip D. |

Fire |

7/1/2011 |

78,481 |

76,318 |

|

97.2% |

|

40 |

Trost, Jay S. |

Police |

8/19/2011 |

62,113 |

58,495 |

|

94.2% |

|

41 |

Janeski, Charles T. |

Police |

9/15/2011 |

68,888 |

70,529 |

|

102.4% |

|

42 |

Hall, Raymond |

Police |

2/18/2012 |

83,342 |

73,178 |

|

87.8% |

As for the 20 more recent retirees, we just don't

know. The City expects us to take their word on the straight life

amounts when they could easily have provided the source documents - the pension calculation

sheets - rather than a compilation, which the FOIA explicitly does not

require. Instead, they fought shamelessly to keep them from public view.

Send comments, questions,

and tips to

stevenrharry@gmail.com, or call or text

me at 517-505-2696. If

you'd like to be notified by email when I post a new story, let me

know.

Previous stories

|