|

Pension discrepancies need to be

explained

October 26, 2018; updated

November 29, 2018

My original story, posted October

26, is below, under the heading Original story. In that story, I wondered why my calculation of pension for 14 Lansing police and

firefighters came out higher than the pension amounts provided to me by

the City. I based my calculation on

2016 payroll information, also

provided by the City. One possible reason, I surmised, was that the final leave payout figure

in the 2016 payroll

information included money that could not be included in final

average compensation (FAC), one of the factors in the pension

calculation.

That turned out to be the answer. I reached that

conclusion after examining a detailed report of payments received in the

last two years of Michael Keith's employment. He is one of he 14, a firefighter who retired 6/30/2016.

At the end of that 15-page report,

which was provided by the City in response to a FOIA request, is a "recap" providing totals. Here

they are, slightly

reorganized.

|

|

|

|

| |

Hours |

Amount |

|

Deductions |

|

SALARY FIXED AMOUNT |

4641.50 |

107,389.97 |

|

FEDERAL INCOME TAX |

13,613.12 |

|

HOLIDAY FIRE |

24.00 |

4,118.38 |

|

STATE INCOME TAX |

5,495.99 |

|

FIRE ACTING ENGINEER |

1150.50 |

910.35 |

|

CITY TAX NON RESIDEN |

774.55 |

|

PAY ADJ W/O RETIREMT |

36.00 |

841.43 |

|

PHYSICIANS HLTH PLAN |

479.10 |

|

HRLY RT ADJ |

8.00 |

182.57 |

|

AETNA LIFE INSURANCE |

181.92 |

|

FLSA RATE ADJ |

4.00 |

54.19 |

|

RETIREMENT FIRE |

16,437.13 |

|

OVERTIME 1.50 FIRE |

813.00 |

28,197.42 |

|

ING |

32,300.00 |

|

FLSA PAY FIRE |

56.00 |

652.63 |

|

FIRE DUES |

1,916.50 |

|

SICK LEAVE FORFEITED |

4610.86 |

0 |

|

FIRE BENEFIT ASSOC |

339.00 |

|

SICK REIMB HRS DEDUC |

36.00 |

356.76 |

|

TOTAL: |

71,537.31 |

|

RETRO PAY |

1.00 |

314.44 |

|

|

|

|

SICK TIME USED |

363.00 |

8,345.52 |

|

|

|

|

VACATION USED |

539.69 |

12,487.79 |

|

NET PAY: |

132,589.22 |

|

PERSONAL LEAVE USED |

88.00 |

2,036.66 |

|

|

|

|

FOOD/CLOTHING |

|

1,918.92 |

|

|

|

|

LONGEVITY PAY |

|

3,200.00 |

|

|

|

|

SICK LEAVE BUYOUT |

680.00 |

21,394.76 |

|

|

|

|

VACATION LV BUYOUT |

408.00 |

9,536.17 |

|

|

|

|

PERSONAL LV BUYOUT |

48.00 |

1,121.90 |

|

|

|

|

LONGEVITY BUYOUT |

|

1,066.67 |

|

|

|

|

TOTAL:

|

|

204,126.53 |

|

|

|

Payments received in his last two years totaled

$204,126.53. His FAC - average annual compensation for his best

consecutive 24 months - was $84,769.50. We know this because when we

know the pension and service amount and we remember our high school

algebra, we can calculate FAC:

If pension equals FAC times service

times .032, FAC equals pension divided by the product of service and

.032. Keith's pension is $67,815.60 and his service was 25 years, so his FAC was $84,769.50.

Double Keith's FAC

and we get $169,539. That's quite a lot less than the $204,126.53 he

received during his last 24 months, which means $34,587.53 of the

compensation he received in that period

was not included in his FAC. According to City

ordinance, this is what is included in FAC for a firefighter:

-

annual base salary

-

overtime pay

-

acting pay

-

ambulance wage

differential pay

-

longevity

-

holiday pay

-

field training instructor pay

-

retroactive pay (prorated by effective date)

That would seem

include only the following items from the recap, although it is hard to tell from the

descriptions:

|

SALARY FIXED AMOUNT |

107,389.97 |

|

HOLIDAY FIRE |

4,118.38 |

|

FIRE ACTING ENGINEER |

910.35 |

|

OVERTIME 1.50 FIRE |

28,197.42 |

|

RETRO PAY |

314.44 |

|

LONGEVITY PAY |

3,200.00 |

|

TOTAL:

|

144,130.56 |

That leaves us $25,408.44 short of the $169,539.

Without more information, I can't determine what additional payments

were included in FAC, and I don't know how to get that information.

Original story

Based on 2016 wage information provided by the City

of Lansing, I calculated pensions for 14 police and firefighters who

retired in 2016. I've compared them below with straight life pension

amounts provided by the City:

|

Name |

Dept |

Retirement

Date |

Age |

Provided

SL Pension |

Calculated

SL Pension |

Difference |

|

Brown, Jeffrey |

Fire |

12/24/2016 |

49 |

59,399.04 |

72,491.14 |

13,092.10 |

|

Baylis, Susan M. |

Police |

11/15/2016 |

47 |

70,517.40 |

112,292.08 |

41,774.68 |

|

Kraus, James |

Police |

8/1/2016 |

54 |

80,312.76 |

119,904.82 |

39,592.06 |

|

Hamel, Michael R. |

Fire |

8/7/2016 |

50 |

72,662.52 |

99,496.03 |

26,833.51 |

|

Keith, Michael A. |

Fire |

6/30/2016 |

54 |

67,815.60 |

81,317.83 |

13,502.23 |

|

Whitney, James |

Fire |

6/25/2016 |

56 |

67,385.04 |

82,526.42 |

15,141.38 |

|

Ankney, David |

Fire |

6/18/2016 |

53 |

69,931.08 |

82,952.64 |

13,021.56 |

|

Hamilton, Donald

J. |

Fire |

6/24/2016 |

52 |

80,333.64 |

103,314.73 |

22,981.09 |

|

Vessel, Greg |

Fire |

6/18/2016 |

52 |

65,866.80 |

80,435.65 |

14,568.85 |

|

Rose, Michael P. |

Fire |

6/24/2016 |

50 |

63,509.40 |

67,759.38 |

4,249.98 |

|

Pawluk, William

W. |

Fire |

6/25/2016 |

47 |

79,763.76 |

99,148.24 |

19,384.48 |

|

Epling, Bryan P. |

Fire |

6/22/2016 |

45 |

66,914.16 |

79,031.86 |

12,117.70 |

|

Medina, Patricio |

Fire |

5/23/2016 |

52 |

71,957.04 |

86,369.37 |

14,412.33 |

|

Oberst, William

A. |

Fire |

2/19/2016 |

54 |

79,163.04 |

92,862.10 |

13,699.06 |

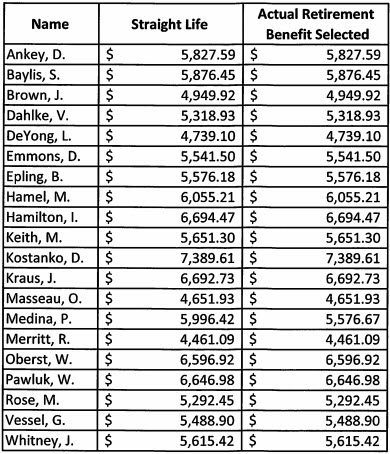

The straight life amounts provided by the City were provided as monthly amounts in the

chart below, which is from an

August 29 letter. I converted them to yearly for the above

chart.

My pension calculations required a lot of assumptions, but

they are reasonable. In the Police and Fire Retirement System, pensions

are calculated as years of service times FAC times 3.2%. For all 14 retirees, years of service was 25. FAC (final average

compensation) is average wages for the employee's best 2 years. I

assumed those were the employee's last 2 years.

In 2017, the City gave me 2016 payroll information for all City employees. You can see it

here. For each

employee, I was given regular wages, overtime, miscellaneous and final

leave payout. Here is the info for our 14 retirees:

|

Name |

Regular

Wages |

Overtime |

Misc |

Final Leave

Payout |

|

Brown, Jeffrey |

67,344.33 |

4,608.72 |

2,568.96 |

34,507.95 |

|

Baylis, Susan M. |

71,049.29 |

3,561.39 |

7,062.64 |

109,991.02 |

|

Kraus, James |

52,519.75 |

2,238.65 |

4,102.60 |

112,969.38 |

|

Hamel, Michael R. |

56,156.30 |

0.00 |

968.96 |

62,403.26 |

|

Keith, Michael A. |

34,948.41 |

7,269.02 |

0.00 |

33,960.93 |

|

Whitney, James |

37,485.27 |

5,065.54 |

0.00 |

30,824.00 |

|

Ankney, David |

36,059.37 |

6,216.21 |

0.00 |

25,845.29 |

|

Hamilton, Donald

J. |

42,851.79 |

9,403.55 |

1,294.15 |

41,545.92 |

|

Vessel, Greg |

36,054.80 |

5,424.10 |

0.00 |

22,973.86 |

|

Rose, Michael P. |

37,416.88 |

52.15 |

0.00 |

13,987.13 |

|

Pawluk, William

W. |

43,150.15 |

8,122.96 |

0.00 |

36,405.24 |

|

Epling, Bryan P. |

36,610.86 |

2,242.66 |

0.00 |

34,573.51 |

|

Medina, Patricio |

30,301.41 |

6,147.74 |

0.00 |

29,854.35 |

|

Oberst, William

A. |

13,213.65 |

181.99 |

0.00 |

36,578.90 |

Regular wages, overtime and miscellaneous are for a

partial year - up until the employee's retirement. Final leave payout is

for things such as accumulated vacation time. Miscellaneous includes

such things as sick leave buy back, longevity and contract signing

bonus, according to

information I obtained in 2011.

To calculate FAC, I assumed that regular wages and

overtime were accumulated at the same rate in the last 24 months as for

the time worked in 2016. I combined regular wages and overtime and

divided by the number of days worked in 2016 (from

this

site), then multiplied by 365 to get annual earnings. (I ignored

miscellaneous payments.) Then I doubled annual earnings, added final

leave payout, and divided by 2, giving FAC.

|

Name |

Retirement

Date |

Regular

Wages |

Overtime |

Days in

2016 |

Annual

Earnings |

Final Leave

Payout |

2 yrs wages

+Final Leave |

FAC |

Calculated

Pension |

|

Brown, Jeffrey |

12/24/2016 |

67,344.33 |

4,608.72 |

358 |

73,359.95 |

34,507.95 |

181,227.86 |

90,613.93 |

72,491.14 |

|

Baylis, Susan M. |

11/15/2016 |

71,049.29 |

3,561.39 |

319 |

85,369.59 |

109,991.02 |

280,730.19 |

140,365.10 |

112,292.08 |

|

Kraus, James |

8/1/2016 |

52,519.75 |

2,238.65 |

214 |

93,396.34 |

112,969.38 |

299,762.05 |

149,881.03 |

119,904.82 |

|

Hamel, Michael R. |

8/7/2016 |

56,156.30 |

0.00 |

220 |

93,168.41 |

62,403.26 |

248,740.07 |

124,370.04 |

99,496.03 |

|

Keith, Michael A. |

6/30/2016 |

34,948.41 |

7,269.02 |

182 |

84,666.82 |

33,960.93 |

203,294.58 |

101,647.29 |

81,317.83 |

|

Whitney, James |

6/25/2016 |

37,485.27 |

5,065.54 |

177 |

87,746.02 |

30,824.00 |

206,316.04 |

103,158.02 |

82,526.42 |

|

Ankney, David |

6/18/2016 |

36,059.37 |

6,216.21 |

170 |

90,768.16 |

25,845.29 |

207,381.60 |

103,690.80 |

82,952.64 |

|

Hamilton, Donald J. |

6/24/2016 |

42,851.79 |

9,403.55 |

176 |

108,370.45 |

41,545.92 |

258,286.82 |

129,143.41 |

103,314.73 |

|

Vessel, Greg |

6/18/2016 |

36,054.80 |

5,424.10 |

170 |

89,057.64 |

22,973.86 |

201,089.14 |

100,544.57 |

80,435.65 |

|

Rose, Michael P. |

6/24/2016 |

37,416.88 |

52.15 |

176 |

77,705.66 |

13,987.13 |

169,398.45 |

84,699.22 |

67,759.38 |

|

Pawluk, William W. |

6/25/2016 |

43,150.15 |

8,122.96 |

177 |

105,732.68 |

36,405.24 |

247,870.61 |

123,935.30 |

99,148.24 |

|

Epling, Bryan P. |

6/22/2016 |

36,610.86 |

2,242.66 |

174 |

81,503.07 |

34,573.51 |

197,579.66 |

98,789.83 |

79,031.86 |

|

Medina, Patricio |

5/23/2016 |

30,301.41 |

6,147.74 |

143 |

93,034.54 |

29,854.35 |

215,923.44 |

107,961.72 |

86,369.37 |

|

Oberst, William A. |

2/19/2016 |

13,213.65 |

181.99 |

50 |

97,788.17 |

36,578.90 |

232,155.24 |

116,077.62 |

92,862.10 |

Once you have FAC, pension can be calculated by

multiplying by .8. Eight-tenths is what you get when you multiply 25

by .032. In other words, when years of service is 25, pension is 80% of FAC.

As you can see from the chart at the top, my

calculated pension for all 14 retirees is higher than the pension

amount provided by the City, and the difference is substantial - over $41,000

in one case. Here are some possible explanations:

For a police officer member, included

compensation is defined as annual base salary, overtime pay

(including holiday pay), longevity, gun allowance, clothing

allowances, sick leave reimbursement (buy-back), shift premium

and retroactive pay (prorated by effective date). For a Police

Supervisory Division Unit member, the definition of included

compensation also includes compensatory time buy-back (up to a

maximum of 160 hours), provided that the compensatory time was

earned in the same 24 months on which final average compensation

is based. For a firefighter member, included compensation is

defined as annual base salary, overtime pay, acting pay,

ambulance wage differential pay, longevity, holiday pay, field

training instructor pay and retroactive pay (prorated by

effective date).

-

Overtime earned was higher than usual in the time

worked in 2016.

-

The City is providing bad information, either

for the straight life pension or the 2016 payroll. Or both.

-

Police and firefighters are getting shorted on

their pensions.

The people of Lansing - and our police and

firefighters - need an explanation.

Send comments, questions,

and tips to

stevenrharry@gmail.com, or call or text

me at 517-505-2696. If

you'd like to be notified by email when I post a new story, let me

know.

Previous stories

|